COLUMBIA, S.C. — Those who filed an extension on their income taxes earlier this year are approaching the deadline to send them in.

Authorities say Oct. 15 marks the deadline to file after a previously requested extension. As such, the South Carolina Department of Revenue has a few reminders to make the process a bit easier.

First off, the agency reminds filers that the extension is for filing and not for payment. So, those who haven't made a payment yet may own additional money in interest or penalties.

Next, the agency suggests filers do so electronically to speed up the process. And, as with filing earlier in the year, review available tax credits that may apply to you.

Also, make sure to file by the Oct. 15 deadline to avoid any other late fees or penalties. For any future concerns that may arise, make sure to keep a copy of your tax return as well.

Many of these suggestions apply to taxes no matter where they're filed. However, one, in particular, is specific to South Carolina and deals with payment. The SC Department of Revenue suggests using a smartphone, tablet, or computer to pay using the state's free MyDORWAY tax system. Otherwise, those who need to start a payment plan can request one from this state website.

As for those expecting a refund, the agency suggests they sign up for a direct deposit, adding that customers can ask their tax preparer to set this up as well. Otherwise, the SC Department of Revenue has a specific webpage set up to explain more about the process refund process.

The state agency also offered up a few suggestions for filers in specific situations. For one, military members who are currently in a combat zone have 180 days after leaving to file their state and federal income tax returns. They can also wait until they come back to pay.

As for people who need to amend a return, an option is available through many tax software providers but filing electronically using "a reputable vendor" is considered the safest method.

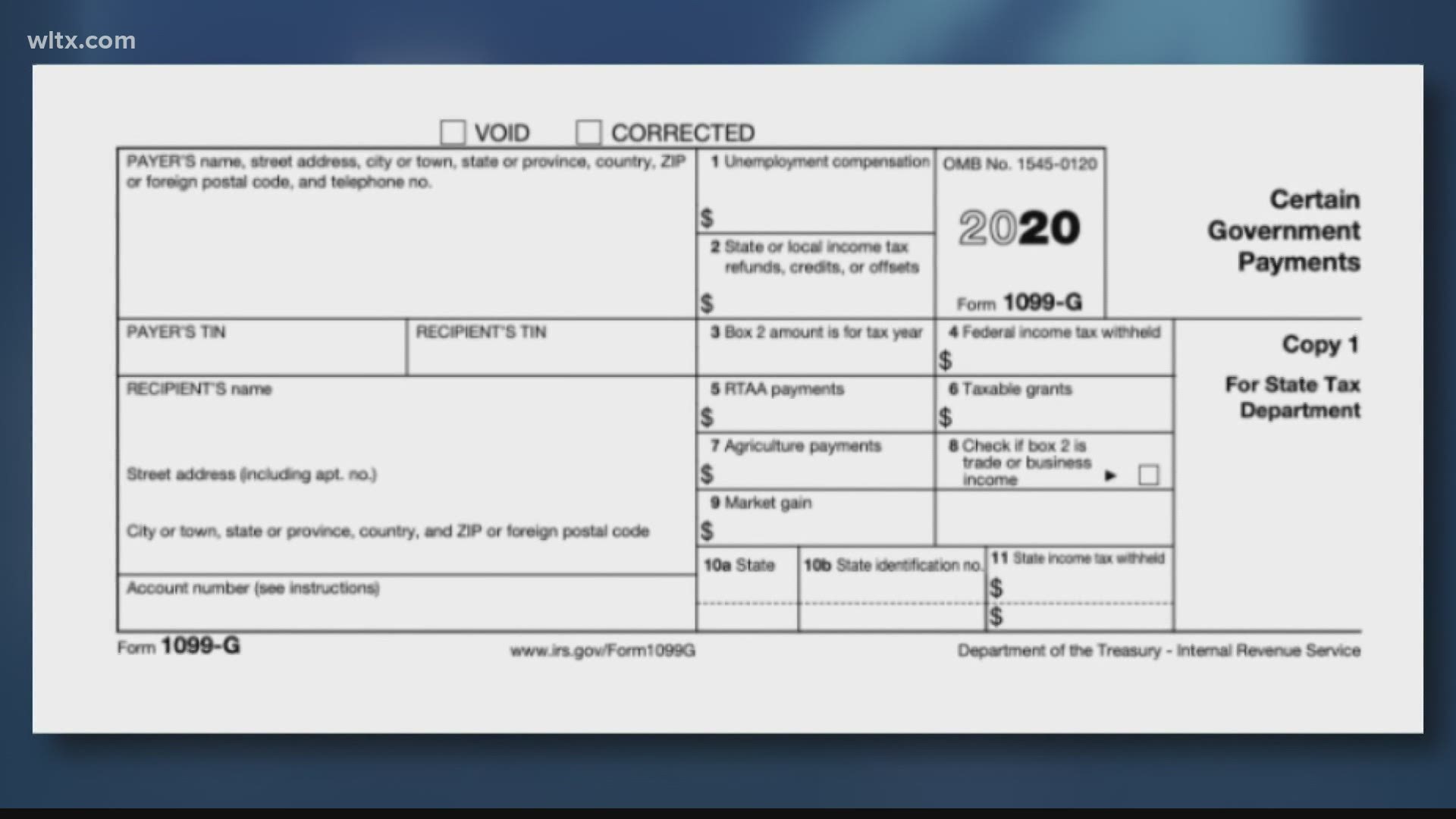

The South Carolina Department of Revenue also has special instructions for those who are amending their returns because of unemployment compensation.