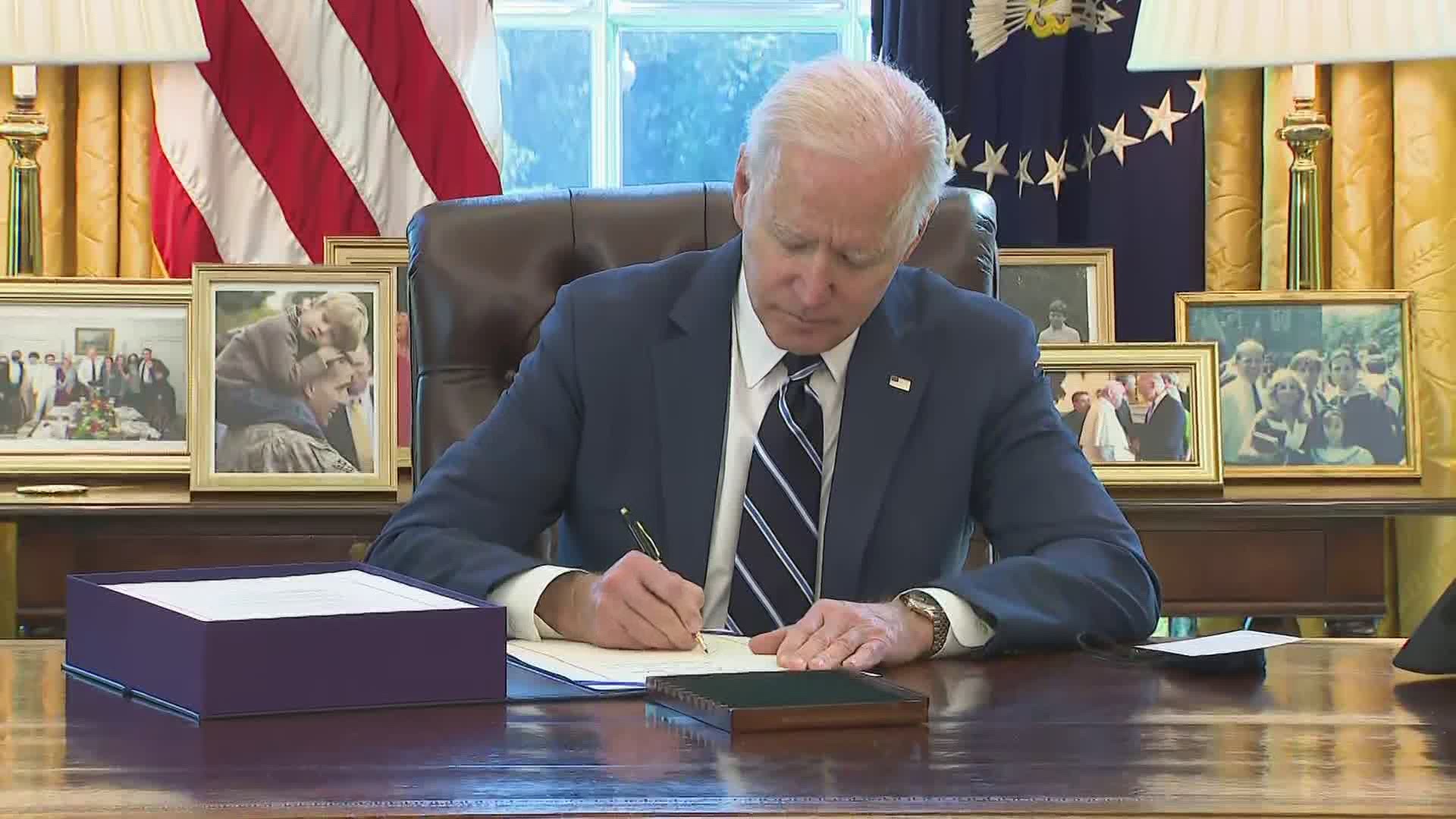

WASHINGTON — After more than two months of anxious waiting by millions of Americans, President Joe Biden has signed into law a $1.9 trillion COVID relief plan which includes $1,400 direct payment stimulus checks.

Congress gave final approval on the “American Rescue Plan” on Wednesday and it then headed to Biden for his signature.

Biden initially planned to sign the bill on Friday afternoon, but White House Chief of Staff Ron Klain tweeted Thursday that the bill arrived quicker than anticipated, so they decided to sign it a day earlier.

Minutes after Biden signed the bill into law, the White House provided a big update to the timeline for when the third round of stimulus checks will start going out.

When will the third stimulus check be sent?

The goal of Democrats was to pass the bill by this Sunday, March 14. That's when extra unemployment assistance and other pandemic aid expires.

With Biden signing the plan on Thursday, Democrats have met that goal.

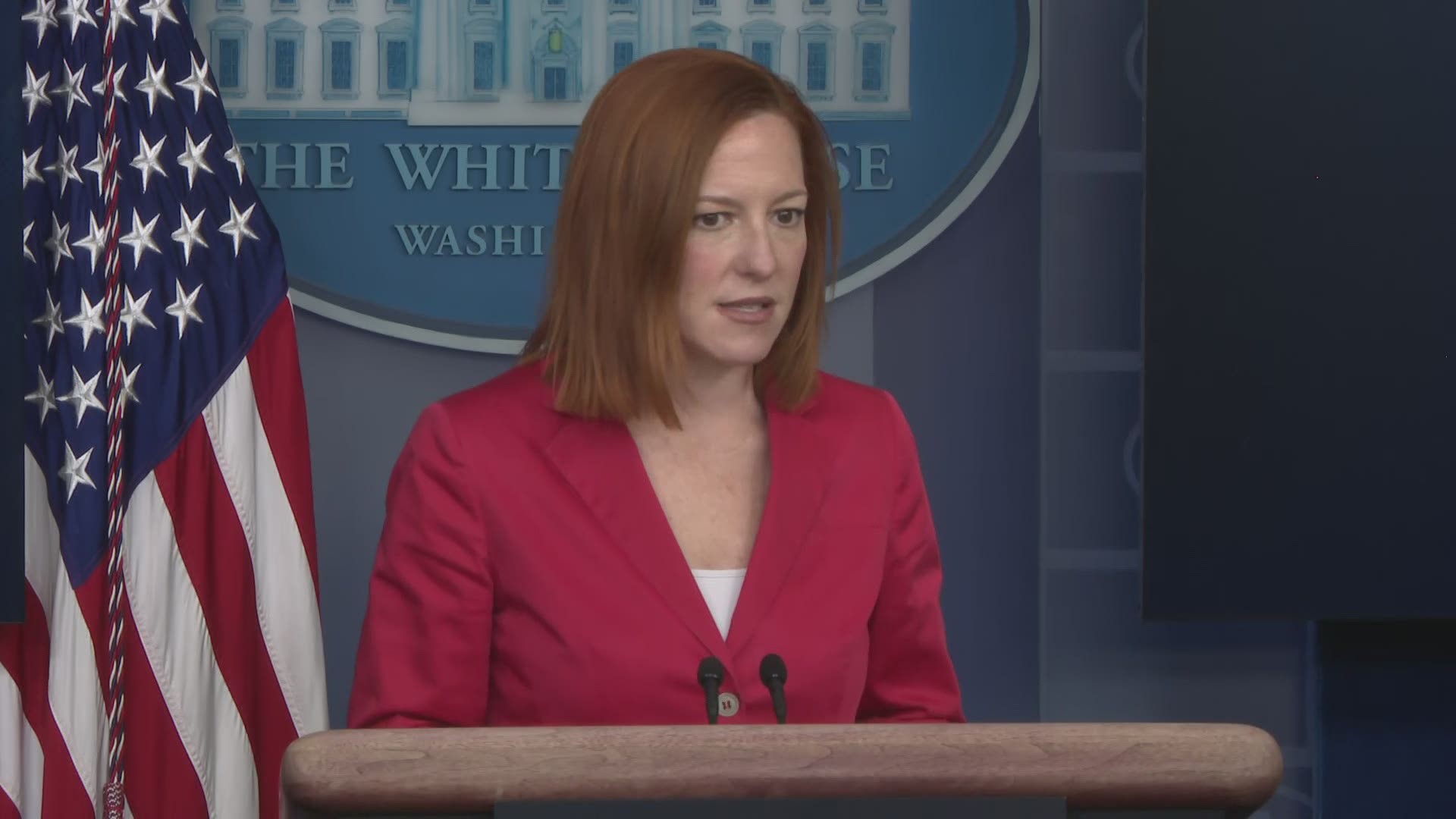

White House Press Secretary Jen Psaki announced shortly after Biden signed the bill that the IRS and Treasury Department are working hard to get payments out. She said some people will see direct deposits hit their bank accounts as early as this weekend.

"This is of course just the first wave, but some people in he country will start seeing those direct deposits in their bank accounts this weekend and payments to eligible Americans will continue throughout the course of the next several weeks," Psaki explained.

The IRS said Friday the payments were already being processed and concurred that direct deposits would start arriving this weekend.

During the first round of stimulus checks in April 2020, it took about two weeks for the federal government to start distributing the money. It took around one week for the second round of checks, worth $600, in early January partly because the infrastructure from the first stimulus was in place.

One factor that could complicate things is that this is also tax season. The IRS will be trying to send out stimulus checks while also processing incoming tax returns and calculating refunds.

Who gets $1,400 stimulus checks?

The House and Senate versions of the bill agreed that individual tax filers making up to $75,000 per year will get $1,400. Couples, who file jointly, making up to $150,000 will get $2,800. There will also be $1,400 tacked on for each dependent in the household.

Where they differed was how quickly the stimulus money would be phased out to zero. The original House bill passed on Feb. 27 called for the phase out to be complete at $100,000 for individuals and $200,000 for couples. But the Senate version passed on March 6 lowered it to $80,000 and $160,000, respectively. That Senate version is what the House passed on Wednesday.

Roughly 8 million fewer households will get a check under the Senate bill compared with what the House passed, according to an analysis from the Tax Policy Center.

CALCULATOR: Here is a tool from Omni Calculator that may help you determine how much you might receive

Why is the stimulus $1,400 and not $2,000?

Biden's plan called for $1,400 checks for most Americans, which on top of the $600 provided in the most recent COVID-19 bill would bring the total to the $2,000 that Biden has called for.

But Biden initially did not make that differentiation. Biden said on January 4 while campaigning for Democrats Jon Ossoff and Raphael Warnock ahead of Georgia's Senate runoff elections, "Their election will put an end to the block in Washington of that $2,000 stimulus check. That money that will go out the door immediately."

What else is in the COVID relief bill?

Expanded unemployment benefits from the federal government would be extended through Sept. 6 at $300 a week. That’s on top of what beneficiaries are getting through their state unemployment insurance program. The first $10,200 of jobless benefits would be non-taxable for households with incomes under $150,000.

Additionally, the measures provides a 100% subsidy of COBRA health insurance premiums to ensure that the laid-off workers can remain on their employer health plans at no cost through the end of September.

The legislation would send $350 billion to state and local governments and tribal governments for costs incurred up until the end of 2024. The bill also requires that small states get at least the amount they received under virus legislation that Congress passed last March.

Many communities have taken hits to their tax base during the pandemic, but the impact varies from state to state and from town to town. Critics say the funding is not appropriately targeted and is far more than necessary with billions of dollars allocated last spring to states and communities still unspent.

The bill calls for about $130 billion in additional help to schools for students in kindergarten through 12th grade. The money would be used to reduce class sizes and modify classrooms to enhance social distancing, install ventilation systems and purchase personal protective equipment. The money could also be used to increase the hiring of nurses and counselors and to provide summer school.

Spending for colleges and universities would be boosted by about $40 billion, with the money used to defray an institution’s pandemic-related expenses and to provide emergency aid to students to cover expenses such as food and housing and computer equipment.

A new program for restaurants and bars hurt by the pandemic would receive $25 billion. The grants provide up to $10 million per company with a limit of $5 million per physical location. The grants can be used to cover payroll, rent, utilities and other operational expenses.

The bill also provides $7.25 billion for the Paycheck Protection Program, a tiny fraction of what was allocated in previous legislation. The bill also allows more non-profits to apply for loans that are designed to help borrowers meet their payroll and operating costs and can potentially be forgiven.

The bill provides $46 billion to expand federal, state and local testing for COVID-19 and to enhance contract tracing capabilities with new investments to expand laboratory capacity and set up mobile testing units. It also contains about $14 billion to speed up the distribution and administration of COVID-19 vaccines across the country.

Parts of the legislation advance longstanding Democratic priorities like increasing coverage under the Obama-era Affordable Care Act. Financial assistance for ACA premiums would become considerably more generous and a greater number of solid middle-class households would qualify. Though the sweetened subsidies last only through the end of 2022, they will lower the cost of coverage and are expected to boost the number of people enrolled.

The measure also dangles more money in front of a dozen states, mainly in the South, that have not yet taken up the Medicaid expansion that is available under the ACA to cover more low-income adults. Whether such a sweetener would be enough to start wearing down longstanding Republican opposition to Medicaid expansion is uncertain.

Under current law, most taxpayers can reduce their federal income tax bill by up to $2,000 per child. In a significant change, the bill would increase the tax break to $3,000 for every child age 6 to 17 and $3,600 for every child under the age of 6.

The legislation also calls for the payments to be delivered monthly instead of in a lump sum. If the secretary of the Treasury determines that isn’t feasible, then the payments are to be made as frequently as possible.

Families would get the full credit regardless of how little they make in a year, leading to criticism that the changes would serve as a disincentive to work. Add in the $1,400 checks and other items in the proposal, and the legislation would reduce the number of children living in poverty by more than half, according to the Center on Poverty and Social Policy at Columbia University.

The bill also significantly expands the Earned Income Tax Credit for 2021 by making it available to people without children. The credit for low and moderate-income adults would be worth $543 to $1,502, depending on income and filing status.

The bill provides about $30 billion to help low-income households and the unemployed afford rent and utilities, and to assist the homeless with vouchers and other support. States and tribes would receive an additional $10 billion for homeowners who are struggling with mortgage payments because of the pandemic.