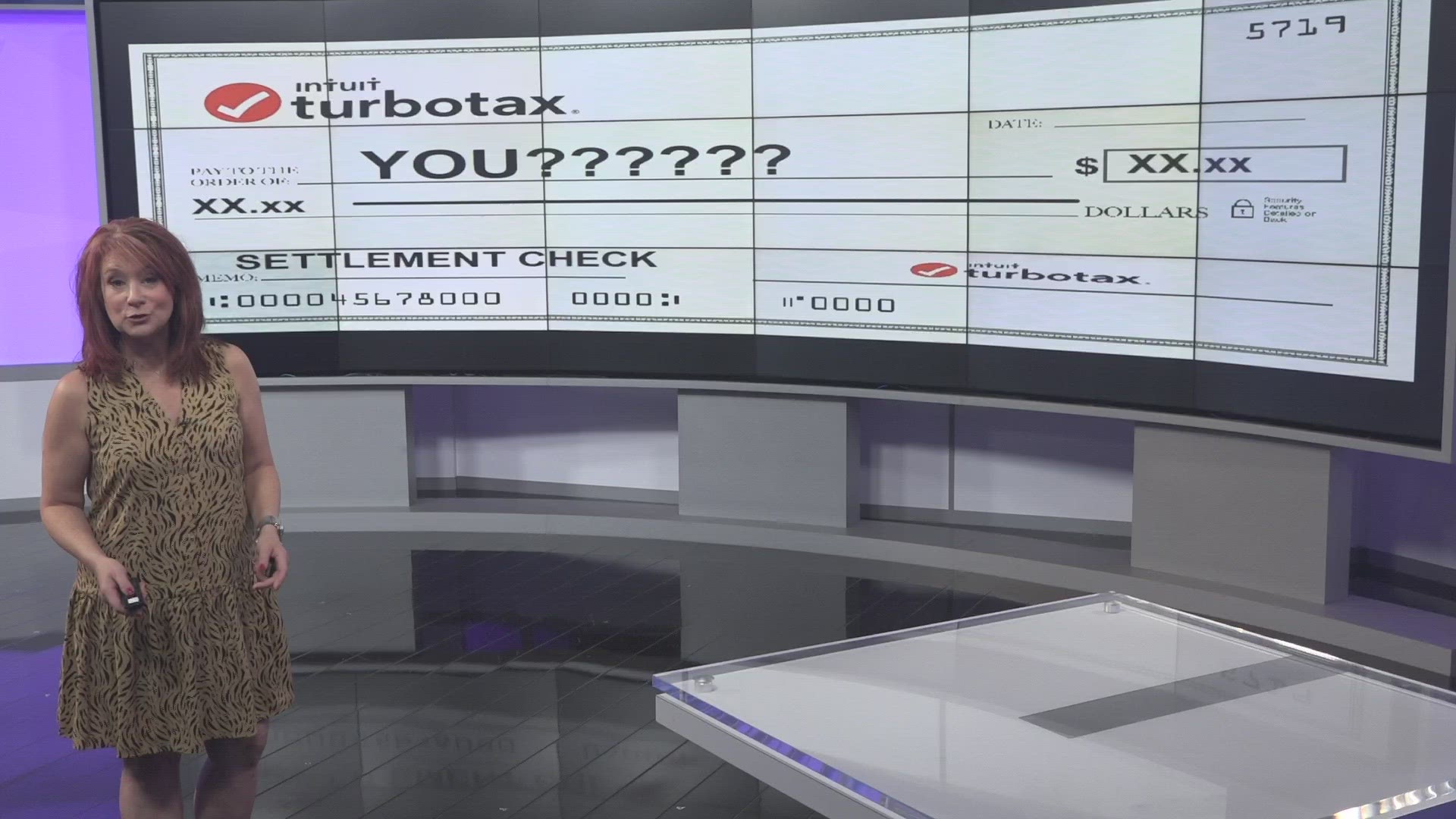

GREENSBORO, N.C. — You've heard about it, Turbo Tax owes customers due to a settlement and checks are being sent out.

The question is, are you getting one? In fact, is everyone who used Turbo Tax getting a check? NO.

You’re eligible for the Turbo Tax check if:

*You used Turbo Tax in 2016, 2017, or 2018

*You qualified for the IRS free file program, but Turbo Tax charged you

Back in 2016, you had to make under $64,000 to qualify for the free file program. It was the same in 2017.

In 2018, the threshold jumped up to $66,000. (For context, in 2023, filing the 2022 taxes, it was $73,000)

If you made under those numbers and used Turbo Tax, you paid for what should have been free, then you're in line to get a check.

What do you have to do to get the check?

The answer is nothing. It is automatically coming to those customers. This point is really important, there is no form to fill out, no information you have to give to anyone, so don't let a scammer tell you otherwise.

When will the check get to you & how can you check it?

Checks are starting to be mailed out this week. You can sign up for informed delivery with the postal service. This free service takes pictures of the letters as they go through the automated sorting machines. Those pictures are then sent to your phone or computer for you to see. With this free service-- you'll know the day your check will be delivered

How to make sure the check is real

When you get the check, you can make sure it's the real thing by putting the check number and claimant id into this checker system.

How much will the checks be?

The short answer is between $30 and $85 depending on how many years you used the service.