COLUMBIA, S.C. — South Carolinians could soon see more money in their paychecks as lawmakers push to cut state income taxes.

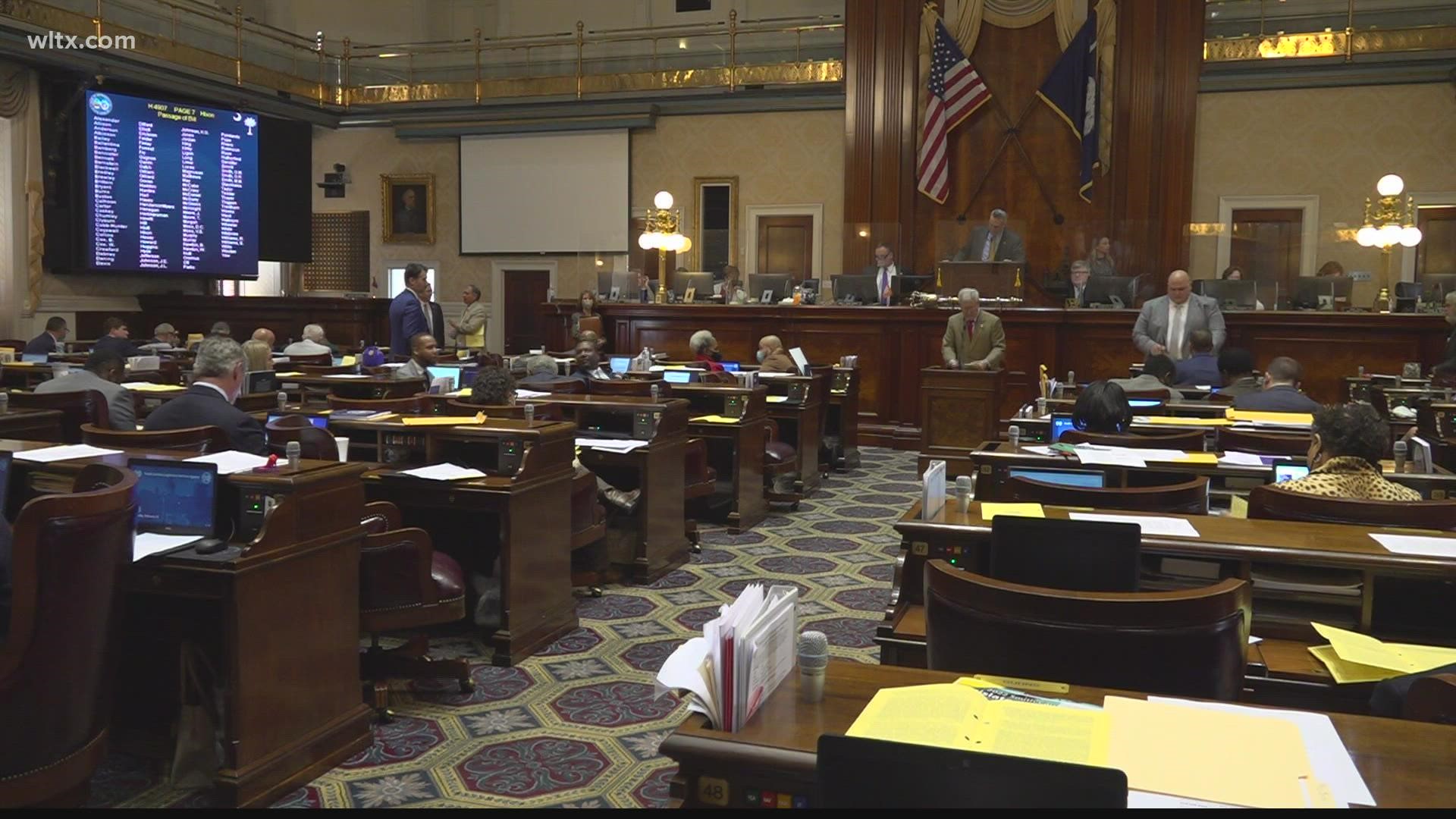

Both the South Carolina House and Senate have passed plans to cut state income taxes this year. Once the Senate gives their proposal one more perfunctory vote on Tuesday, the chambers will need to compromise to decide what the final legislation will look like.

In both plans, taxpayers save money on income taxes, but the amount they pay varies in the proposals.

The House’s plan lowers the top income tax rate from 7% to 6.5% immediately, then it would gradually go down to 6% over the course of five years. The Senate’s plan immediately lowers the top income tax rate from 7% to 5.7%.

Senate Majority Leader Shane Massey told News19, "The [Senate] plan would make us below our neighbors on our income tax proposals, and that’s an important competitive advantage where we want to be.” In other words, Massey thinks dropping income tax rates below North Carolina and Georgia's rates will attract growth to South Carolina.

When comparing the two plans, Massey said, "the Senate’s proposal is bigger and a little bolder than what the House did.”

In the Senate’s plan, if someone has around $58,000 of taxable income, they’d pay about $560 less a year on state income taxes than the current rate. In the House’s plan, that same person would pay about $400 less in the first year than the current rate. Then, they would save a little more each year as the income tax rate decreases over a period of five years, as stated in the House's proposal.

However, when looking at lower income earners, the House plan saves them more money than the Senate’s. For example, according to the South Carolina Revenue and Fiscal Affairs Office, someone that has around $26,000 of taxable income would save about $245 on income taxes in the House proposal compared to the current rate. In the Senate proposal, they'd save about $144 compared to the current rate.

“I think right now the people that make less money are probably feeling it a little more, feeling the inflation a little more, and probably need a little more,” taxpayer Warren Hankinson told News19.

Hatkinson works full time in the City of Columbia and said he'd be happy to pay less in taxes.

The Senate’s plan also includes a one-time rebate for all South Carolina tax payers that file for 2021. Tax payers could get anywhere from $100 to $700 back by the end of the year based on their return. “The more you pay back into the system, the more you get out of it -- up to $700," explained Senator John Scott. "So, if you earn a million dollars and pay $80,000 in taxes, and I pay $50,000 in taxes, we’re both going to get the same $700.”

The proposals in both chambers also exempt military retirement income from taxes. The Senate's bill has a plan for reducing property taxes for manufacturing businesses.

So what happens next? Senator Scott said the House and Senate will soon have to compromise on their proposals. Senator Massey added that the compromise will likely happen soon as work on the state budget looms.

For the compromise, three members from the House and three members from the Senate will meet for a conference committee. "They will sit down and iron out all the differences in that piece of legislation,” said Scott.

Both bodies will need to approve the committee’s compromise before sending it to the Governor.