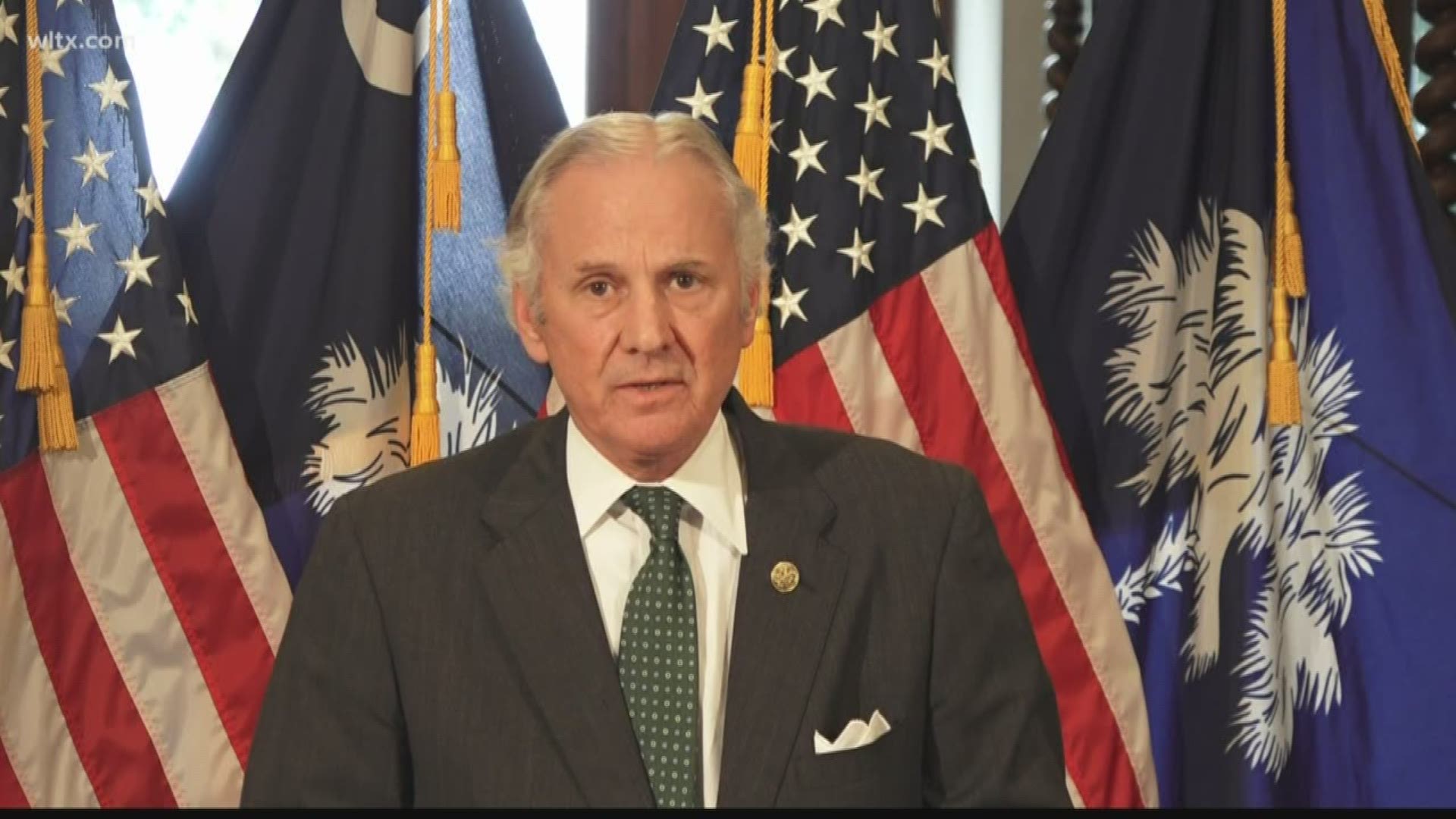

COLUMBIA, S.C. — Governor Henry McMaster formally announced his executive budget a day before lawmakers return to the State House for the 2020 session.

The proposal, facing future debate in both chambers, sets to use the $1.8 billion expected budget surplus through a variety of department expenses, tax rebates and cuts.

“South Carolina is roaring into the twenties with a vibrant economy, innovation and a growing population. This provides opportunities of unlimited prosperity for our people,” McMaster wrote in a letter addressed to the citizens and General Assembly of South Carolina.

The Governor’s Office said on Monday it had already had conversations about the Governor’s budget with Senator Hugh Leatherman, (R) Florence and Chairman of the Senate Finance Committee, as well as Rep. Murrell Smith, (R) Sumter and Chairman of the House Ways and Means Committee.

The following are some of the Governor’s biggest budget priorities and policy directives.

Tax Policy

The Governor plans on returning a quarter of every surplus dollar to the taxpayer in tax cuts and rebates, according to his executive budget and staff. To achieve this, Governor McMaster proposes a $250 million-line item for rebate checks back to the taxpayer.

The rebate checks would work like the ones sent last year using the state’s lottery tax windfall of $61 million from the Mega Millions winner.

"We're going to have taxes, because we need to have taxes to run the critical functions that government has. But if more money comes in than we need to run those functions, it ought to go back to those taxpayers and let them spend it, however they want to spend it," McMaster said, pushing back when asked if the rebate, criticized by some lawmakers last year, was a gimmick.

The Governor is also urging lawmakers to cut taxes on income, starting this year. The tax cut would apply to all taxpayers and be implemented over five years. However, the Governor’s Office says the cuts would be stayed for any year that does not meet 5 percent of growth in revenue in the state’s General Fund.

McMaster is also urging lawmakers to cut taxes on South Carolina veterans’ retirement pay. His office says the cut would cost $9.2 million. His office also described it as a major priority, saying it would improve South Carolina’s standing with the Department of Defense and Pentagon as future base and mission decisions are made.

They also want to cut taxes on first responders’ retirement pay, which would cost $9.3 million.

Education

The Governor is pushing for a $3,000 raise for every teacher, which his office described as a bigger raise than 5 percent for any teacher currently making less than $60,000.

"Very very competent teachers that we want to keep, we don't have enough of them. And we want to- that is the best way, we believe, to deliver that message that we value that excellence and we want them to be a part of this great prosperity we have in South Carolina," McMaster said.

The raises would be funded 100 percent with state money, applying to every teacher across the board, according to the Governor’s office.

It would cost $213 million in Fiscal Year 2020-2021, according to office staff. Staff also said the raise would bring South Carolina into the top 25 national rankings of teacher salary and exceed the southeastern average by $2,456.

The Governor also wants four-year-old kindergarten extended state wide to any student receiving Medicaid. The expansion to the last 17 school districts not already included in existing 4k programs would cost $52.7 million, according to the Governor’s Office.

McMaster is also continuing his campaign pledge of getting school resource officers (SROs) in every school every day across the state. The move would cost $23.4 million and was described by staff as the completion cost to implement the policy statewide. The budget also includes an additional $1.1 million for mental health counselors in schools. The $1.1 million would allow the addition of 20 more counselors and cover other costs.

The budget would raise the allowance for classroom materials from $275 to $400 for every teacher.

The Governor also wants to give $21.7 million to base student cost increases. However, the increase comes attached with a cell phone ban on classrooms during instructional time. The individual school districts would have to decide how to implement the ban, according to the Governor’s Office.

$71 million would go towards the removal and replacement of Common Core math textbooks across the state.

South Carolina Army and Air National Guard servicemembers would also receive full college tuition, costing $3 million.

In a major move, as described by the Governor’s Office, McMaster is recommending the General Assembly use all $162 million of the Capital Reserve Fund to repair aging campus buildings and infrastructure at all the state’s colleges and technical schools.

For example, USC would receive more than $21 million, and Clemson would receive nearly $16 million. Greenville Technical College would receive more than $11 million, according to the same summary documentation.

The Governor’s Office said McMaster was focused on encouraging lawmakers to invest in buildings and infrastructure without passing a bond bill with large payments attached.

Public Safety

$38 million would be used to pay for raises for ‘recruitment and retention.’ The $38 million would be split amongst South Carolina’s many law enforcement agencies.

For example, the Department of Corrections would receive $14.5 million, the Department of Juvenile Justice $8.5 million, and the Department of Public Safety $5 million.

The Governor’s Office said currently, the Highway Patrol currently has 791 filled sworn-officer positions and 130 vacancies. The $5 million could be applied to raises or other items to help fill positions or retain current employment numbers.

The Governor is also urging the General Assembly to give a one-time $100 million check to make prisons ‘safer on the inside and outside.’ The costs would go to replacing and repairing infrastructure, facilities, control systems, and items like gang safety and violence prevention.

Good Government and State Employees

$33 million would go towards merit-based state employee raises, according to the Governor’s executive budget.

When asked why state employee raises would be merit-based, unlike teachers, the Governor’s Office said the teacher raises across the board help stop the level of first through fifth-year teachers leaving the position due to poor pay. Whereas the merit-based raises address different perceived issues in state departments and agencies.

"It has been demonstrated in private business as well as other places that when you have a director who knows the talents and the performance of the employees, that that would be the best way to do that at this time," McMaster said at his press conference.

The $33 million would be the same allotment as a 2 percent raise across the board, according to the Governor’s Office.

Some lawmakers this year have expressed significant interest in passing a state employee pay raise.

This year’s budget proposal also includes closing the state’s pension by the end of the year, forcing new employees to enroll in a 401k-type plan. The Governor’s Office said the current, unfunded $24-billion in pension responsibility was reason to close the system.

The Governor’s Office also said McMaster would focus on transparency in this year’s budget, requiring all appropriations to be publicly disclosed, debated, and allowed to stand on merits as line items. McMaster also wants all local lobbyists to register with the State Ethics Commission and to raise the lobbying fee to $200. The fee is currently $100.

Some lawmakers and Governor McMaster are also pushing for simplification of the state’s business license program. The Governor’s proposal would create a simplified, unified portal in state government so businesses register once. The Governor’s Office said the proposal is already facing stiff opposition from municipalities over the potential lost fees and whom would receive the licensing money.

Lawmakers return to the State House on Tuesday, January 14th.