COLUMBIA, S.C. — April is financial literacy month, and the SC Treasurer's Office is reminding South Carolinians about a fund dedicated to unclaimed money.

According to the treasurer's office, the money in the Unclaimed Property Program comes from overpaid university fees, overpaid property taxes, uncashed checks, insurance claims, inheritances, and more.

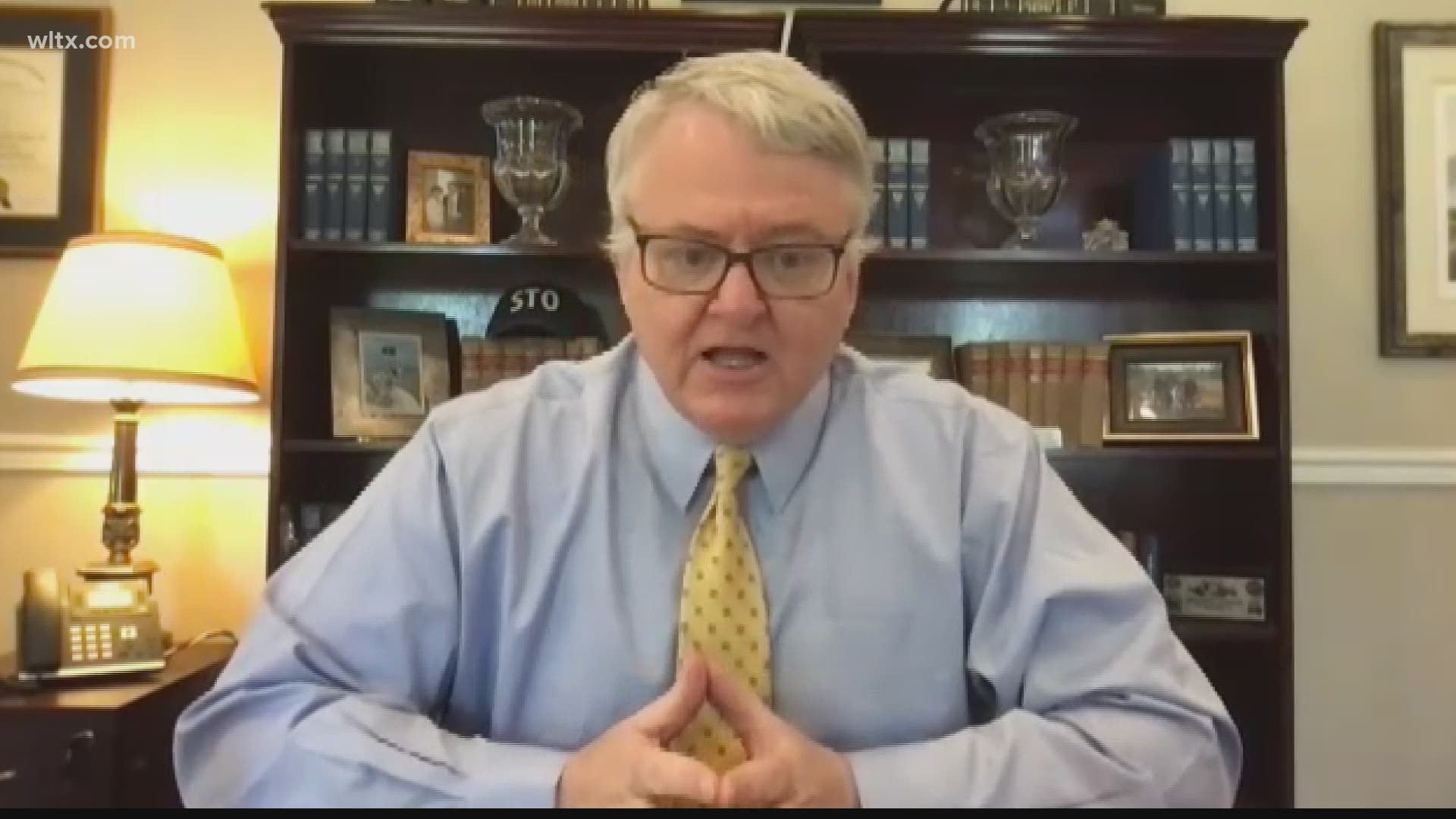

Curtis Loftis, State Treasurer, says this money is ready to go and waiting for people to claim it. According to him, the issue is that most people are unaware this money is available.

"When you're thinking about money, a lot of money gets lost, it gets in the system and people just don't know...so we have at the state Treasurer's office something called the unclaimed property," Loftis said.

According to Loftis, the money in the program 'gets lost' and is sent to the office. He says the program has $700 million that belongs to residents. There's also a share of about $250 million owed to minority and rural communities.

Loftis has been advocating for more financial literacy education in schools so good habits are created early.

Although financial literacy is in state school curriculum, Loftis believes that with all the other requirements, students aren't able to in-depth with financial education.

"So there's just not enough time," Loftis said.

Currently, the state has private money from banks that it uses to pay teachers to learn financial literacy and incorporate it into the curriculum. Loftis said this a win-win because it teaches both the adults and students to be better with money.

A 2019 survey of over 30,000 college students found that only 35% had taken a personal finance class. Another study found that adults who had taken a financial education class in high school enjoyed better credit scores than their peers.

For parents who want to start teaching money management to their children at home, Loftis has a few suggestions.

Describe your approach to financial matters and obligations: Your age-appropriate conversations won’t need to delve into actual numbers to communicate your values when it comes to money.

Discuss the difference between Needs versus Wants: Demonstrating the importance of delayed gratification and how to save up for future wants, as well as weaving in topics like credit card debt, insurance or taxes into daily conversations can make them more familiar and less threatening.

Plan for long-term goals: Whether it’s saving for a new house, a vacation, college or even retirement, show them how regular contributions can grow savings through the wonders of compound interest.

The Treasurer's website has a list of resources available to educate kids, adults, help manage credit, and learn to save.