GREENSBORO, N.C. — The countdown is on. All stimulus payments have to be made by January 15. If the payment isn't made to you, or you didn't get the full amount, are you out the money altogether?

Nope. You still have a chance to cash in on your tax return.

“In some cases, there may be people who didn't get one or both stimulus payments, but by filing the 2020 tax return and making sure line 30 is completed, they may be able to get a refundable credit if they did not get a check in the mail or direct deposit,” said Kevin Robinsons of Robinson Tax and Accounting Services.

The 2020 tax return has a specific line for you to claim the stimulus money. It's line 30 and it reads Recovery Rebate Credit.

The IRS confirms: You may be able to claim the recovery rebate credit if

*You are eligible but not issued the payment

*Or your payment was less than $1,200 for an individual ($2,400 married) plus $500 for each qualifying child you had in 2020

WHO IS ELIGIBLE?

A1. Generally, if you are a U.S. citizen or U.S. resident alien, you will receive an Economic Impact Payment of $1,200 ($2,400 for a joint return) if you (and your spouse if filing a joint return) are not a dependent of another taxpayer and have a Social Security number valid for employment and your adjusted gross income (AGI) does not exceed:

- $150,000 if married and filing a joint return

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing status

Your payment will be reduced by 5% of the amount by which your AGI exceeds the applicable threshold above.

You are not eligible for a payment if any of the following apply to you:

- You may be claimed as a dependent on another taxpayer’s return (for example, a child or student who may be claimed on a parent’s return or a dependent parent who may be claimed on an adult child’s return).

- You do not have a Social Security number that is valid for employment.

- You are a nonresident alien.

The following are also not eligible: a deceased individual or an estate or trust.

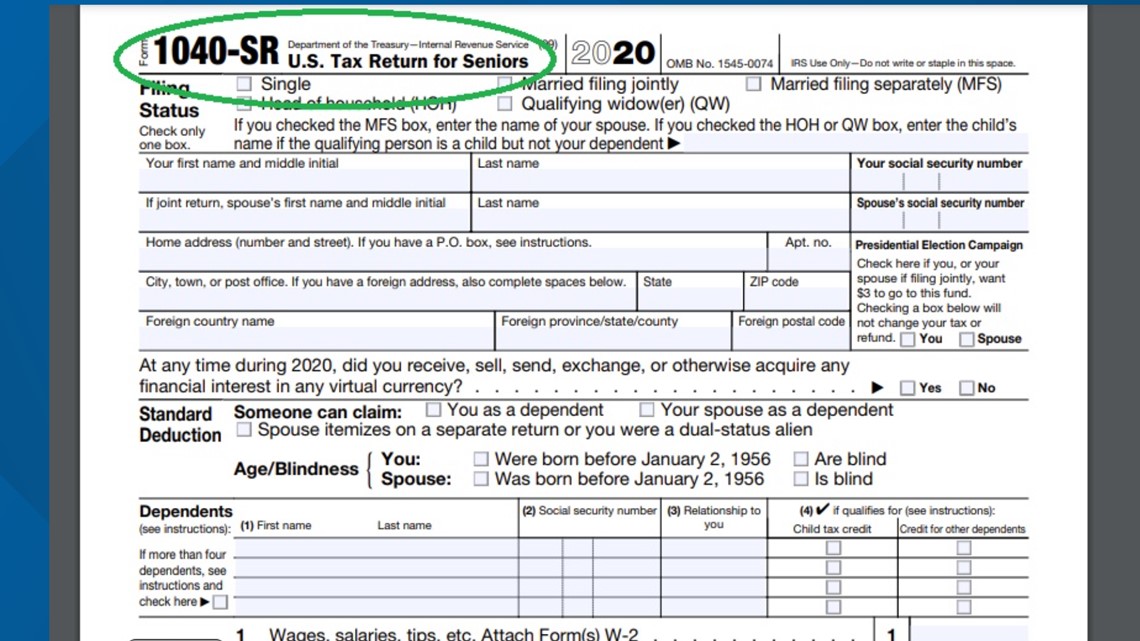

What if you're a senior and you don't usually file taxes?

The IRS has a specific tax return form for you, it’s the 1040-SR.

This form is designed to make it easy for seniors with uncomplicated returns. It is three pages and on line 30 is the Recovery Rebate Credit. Your tax form will come with a worksheet to help you figure out what you need to put in there.

IRS HOW TO FILE

Every taxpayer will see line 30 on their tax return this year.

Every taxpayer will have to claim how much they got, not because you're being taxed on it, but to make sure you got the full credit and are not owed money.